Axis Funded is a broker-backed A-book prop firm that copies trades directly to live markets, letting the company win when traders win. This 2025 review breaks down its instant funding options, challenge accounts, payout speed, and real execution model to see how it compares with other top A-book firms.

Axis Funded is a broker-backed prop firm that gives traders access to real market funding. It runs on an A-book model, which means trades are copied to live market accounts instead of staying on demo servers. This setup makes Axis one of the few prop firms that actually earns when traders earn.

The firm offers instant funding and evaluation-based challenges for traders of all skill levels. You can start with as little as $5,000 and scale up to $2,000,000. Axis promotes fast payouts, transparent trading rules, and real-market exposure for funded traders. Because it’s broker-backed and A-book, there’s no conflict of interest between the company and its traders.

What Is Axis Funded?

Axis Funded runs as a true A-book prop firm, meaning your trades are not kept on a simulation. When you open a position, it’s copied through a trade copier into Axis’s live institutional account. This model lets traders see real-market impact and keeps the firm’s profit linked directly to trader success.

The company is officially registered as Axis Funded Ltd (4041 LLC 2025) in St. Vincent and the Grenadines. While SVG is not a highly regulated jurisdiction, Axis operates transparently and connects with licensed liquidity providers through its broker partners.

Axis describes itself as broker-backed, supported by a financial technology group that has received several industry awards. These include recognition from the Global Forex Awards, UF Awards, and Finance Magnates London Summit (FMLS) for innovation and trading technology.

This combination of live-market execution, fast funding, and award-winning tech is what places Axis among one of the best A-book prop firms in 2025.

Key Features and Benefits

Axis Funded gives traders direct access to live market funding with account sizes up to $400,000. Everything about the setup is built for transparency and fast execution.

Instant access to capital

Traders can choose between evaluation programs or instant funding. Instant accounts let you start trading the same day, with no waiting or challenge steps.

Real market execution

Axis runs on a full A-book structure, which means your trades are copied to live market accounts through a trade copier. This creates a fair environment where Axis profits only when traders profit. If you’re not sure what an A-book model is, you can check our guide on the difference between A-book and B-book prop firms.

Fast payouts

Payouts are processed within 24 hours, and crypto withdrawals often arrive in under an hour. Axis handles withdrawals daily, which gives traders consistent access to their earnings.

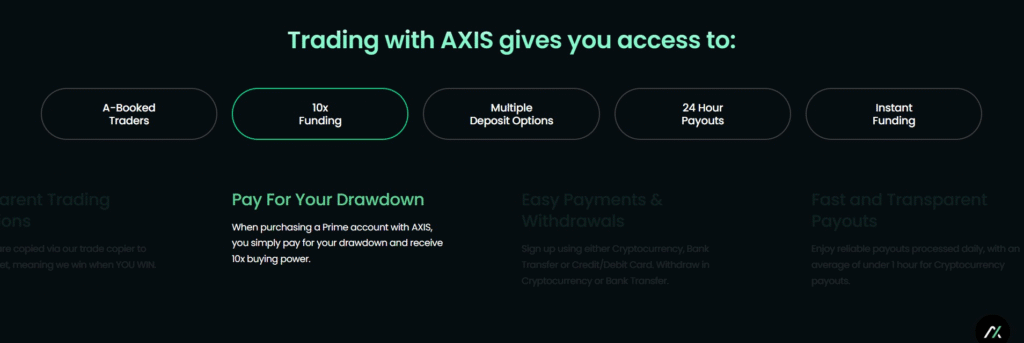

10x buying power

The “Pay for Your Drawdown” model lets traders purchase only the drawdown amount instead of the full account value. This gives ten times the buying power at a lower upfront cost.

Transparent conditions

Axis publishes all drawdown limits, profit splits, and rules clearly on its site. There are no hidden restrictions, resets, or forced time limits.

Numerous payments

Traders can sign up or withdraw using cryptocurrency, bank transfer, or credit and debit cards. Crypto options are the fastest and most common among funded traders.

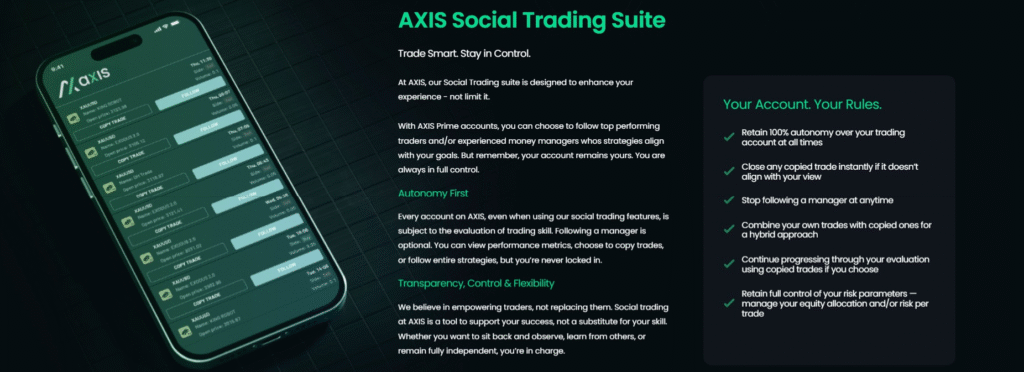

Social trading suite

Prime accounts include access to the Axis Social Trading Suite, which lets traders follow top performers or mix copied trades with their own. You can copy strategies while staying in full control of your account.

Account Types

Axis Funded offers four main account types. Each one fits a different kind of trader, from cautious challenge traders to professionals who want instant access to live capital. All accounts run under the same A-book structure, meaning trades are executed in real markets, not on simulated servers.

CORE Account

The CORE account follows the traditional prop firm challenge model. It’s built for traders who want structure and discipline before managing live funds.

- One or two-phase evaluation

- 80% profit split

- Bi-weekly withdrawals

- Consistency and lot-size rules apply

- Lower entry price than other account types

CORE accounts are ideal for traders who want to prove consistency with clear rules and a fair drawdown system before unlocking funding.

PRO Account

The PRO account is similar to CORE but with more freedom. It’s aimed at skilled traders who already understand risk management and want faster access to payouts.

- One or two-phase evaluation

- 90% profit split

- On-demand withdrawals

- Fewer restrictions on strategy and trade frequency

- Same max drawdown and targets as CORE, but looser rules

PRO traders get paid faster and can trade with more flexibility while still showing consistent results.

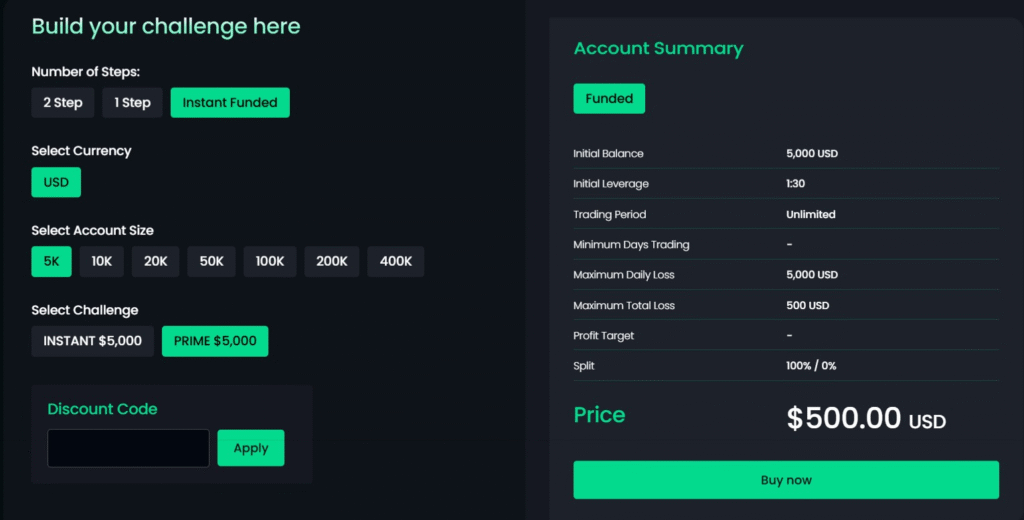

INSTANT Account

The INSTANT account removes evaluations completely. Traders receive live funding immediately and can start earning from day one.

- No evaluation or profit target

- 70% profit split

- Bi-weekly payouts

- 7% total drawdown limit

- Unlimited trading period

This setup is designed for experienced traders who already have a proven strategy and prefer instant access over challenges.

PRIME Account

The PRIME account is Axis Funded’s top-tier program. It offers instant funding with maximum freedom and higher profit potential.

- No evaluation or restrictions

- 90% profit split

- On-demand payouts

- Expert Advisors (EAs) and social trading fully allowed

- 10–15% max drawdown

- No lot-size or consistency rules

PRIME accounts also include Axis’s unique “Pay for Your Drawdown” model. Instead of paying for a full $100,000 or $500,000 account, you only pay for the drawdown risk. This gives you 10x buying power for example, paying $1,000 for a $10,000 drawdown grants $100,000 in trading capital. It’s a cost-efficient way to manage real exposure while keeping risk defined.

Trading Rules and Payout Conditions

Axis Funded keeps its rules simple and transparent, which is part of what makes it one of the best A-book prop firms to trade with. All account types follow clear limits and payout conditions that focus on risk control, not time pressure.

Unlimited trading period

Every Axis account comes with unlimited trading days. There are no forced time limits or deadlines to reach profit targets. Traders can work at their own pace without worrying about resets or disqualifications.

No time pressure or resets

If a trader hits the drawdown limit, the account can be restarted by purchasing a new challenge, but there are no automatic resets or hidden time conditions. The focus stays on skill and consistency rather than rushing trades.

Daily and total drawdown limits

Each account has two risk limits: a daily drawdown cap and a total account drawdown. For example, CORE and PRO accounts typically allow around 4 to 5 percent per day and 7 to 10 percent overall. PRIME accounts offer more flexibility, with up to 15 percent total drawdown depending on size.

Payouts processed daily

Axis processes withdrawals every day. Crypto payouts usually clear in under an hour, while bank transfers may take a few hours depending on the method. The company promotes a 24-hour payout promise, and most traders report getting paid the same day.

Same-day funding

For instant and PRIME accounts, traders receive funding within hours of payment approval. There’s no evaluation delay or waiting period. You can begin trading the same day you join.

These trading and payout rules make Axis stand out from many other prop firms that rely on strict time limits, inconsistent payout windows, or internal profit delays. It’s a system designed for traders who value real execution and fast, dependable payments.

Social Trading and Technology

Axis Funded offers a modern trading setup built around flexibility and control. One of its standout tools is the Axis Social Trading Suite, a feature that lets traders copy or follow strategies from top-performing accounts without giving up ownership of their own.

With this system, you can track the performance of experienced traders and choose to mirror their trades, adjust your exposure, or combine their setups with your own. The copied trades appear in your account instantly, but you always have the final say, you can close any position at any time.

This hybrid model gives traders both autonomy and support. It’s especially useful for newer traders who want to learn from live performance data while still managing their own risk.

Axis makes all of this accessible through multiple platforms:

- Web Trading Platform for browser access

- Mobile apps on both iOS and Android

- Full synchronization between desktop and mobile so trades update in real time

The social trading tools and live-market connection make Axis more than just a prop firm. It’s a full trading ecosystem that bridges retail and institutional environments.

Funding Structure and Scaling

Axis Funded gives traders various capital growth through its scaling plan. Starting accounts range from $5,000 up to $400,000, with the potential to scale to $2 million based on consistent performance.

Traders begin with either an evaluation account (CORE or PRO) or instant funding (INSTANT or PRIME). Those who prove consistent profitability in the evaluation phases qualify for higher capital allocations through the “Increase Capital” process.

Instant-funded traders skip evaluations entirely and trade with live capital immediately. Profitable performance over time can still lead to larger account sizes, but without extra challenges or waiting periods.

This approach keeps funding growth performance-based rather than subscription-based, rewarding traders who manage risk responsibly and show consistency over time.

Payments, Withdrawals, and Fees

Axis Funded keeps its payment system simple and quick. Traders can choose from several deposit and withdrawal options designed to work worldwide.

Deposits

Axis accepts payments through cryptocurrency, bank transfer, and credit or debit cards. Crypto is the most popular choice since it clears the fastest and avoids international banking delays.

Withdrawals

Traders can withdraw profits using cryptocurrency or bank transfer. Payouts are processed daily, and crypto transactions usually arrive in under one hour. Bank transfers can take longer depending on the receiving bank.

Fast processing

Axis promotes 24-hour payouts across all accounts. PRIME and INSTANT traders often receive payments the same day they request them.

Transparent fees

Axis uses a simple pricing setup. For instant and PRIME accounts, traders pay only for the drawdown amount, which defines their risk and buying power. Challenge accounts have a one-time entry fee, and there are no payout or withdrawal charges on profits.

This clean payment system supports Axis’s focus on transparency and quick access to capital, which are key advantages for traders relying on steady payouts.

Awards and Recognition

Axis Funded is part of a broker-backed fintech group that has received multiple industry awards over the last few years for innovation, technology, and transparency.

- Global Forex Awards (2021–2023) — Recognized for excellence in financial technology and client support.

- UF Awards (2022–2023) — Honored for innovation and broker solutions in the prop trading space.

- FMLS 2023 — Won Best Investment Through App Provider at the Finance Magnates London Summit, highlighting its mobile and app integration.

These awards show that Axis operates within a wider, recognized trading ecosystem rather than as an isolated prop firm. Its reputation for fast execution, tech-driven systems, and A-book transparency has helped it gain visibility among serious traders and fintech reviewers alike.

Pros and Cons

Pros

- True A-book model — All trades are copied to live market accounts, meaning the firm earns only when traders do.

- Instant funding options — Traders can start trading real capital on day one without evaluations.

- 24-hour payout cycle — Withdrawals are processed daily, with crypto payouts often arriving in under an hour.

- Realistic drawdown structure — Clearly defined daily and total drawdowns keep accounts fair and manageable.

- Multiple payment methods — Supports cryptocurrency, bank transfer, and card payments for global accessibility.

- Award-winning fintech ecosystem — Backed by a group recognized for innovation and transparency across the trading industry.

Cons

- Instant funding costs more — Paying for drawdown access offers faster capital but requires a higher upfront fee.

- Newer brand — Axis is still building its long-term track record compared to older, established prop firms.

Final Verdict

Axis Funded separates itself from traditional B-book prop firms by running a true A-book model, where trades are executed live, not simulated. This removes the conflict of interest that most prop firms face and creates a fairer setup where the company benefits when traders succeed.

With instant funding, daily payouts, and transparent rules, Axis gives traders one of the most direct paths to real-market trading in 2025. Its fintech foundation, award recognition, and broker backing make it stand out among modern prop firms.

Still, traders should remember that Axis operates under an offshore registration, which means it doesn’t offer the same regulatory protection as a fully licensed broker. For skilled, risk-aware traders, though, Axis Funded is one of the best A-book prop firms available today, combining real-market execution, professional infrastructure, and fast access to capital.