Fast Track Trading (FTT), a futures prop firm that launched only six months ago, has officially shut down operations, leaving traders without access to their accounts and millions in unpaid payouts. The Fast Track Trading shut down has highlighted significant risks associated with firms that has unusually high payouts. Here’s what happened and the critical lessons traders can take from this situation.

Details on the Fast Track Trading Shutdown:

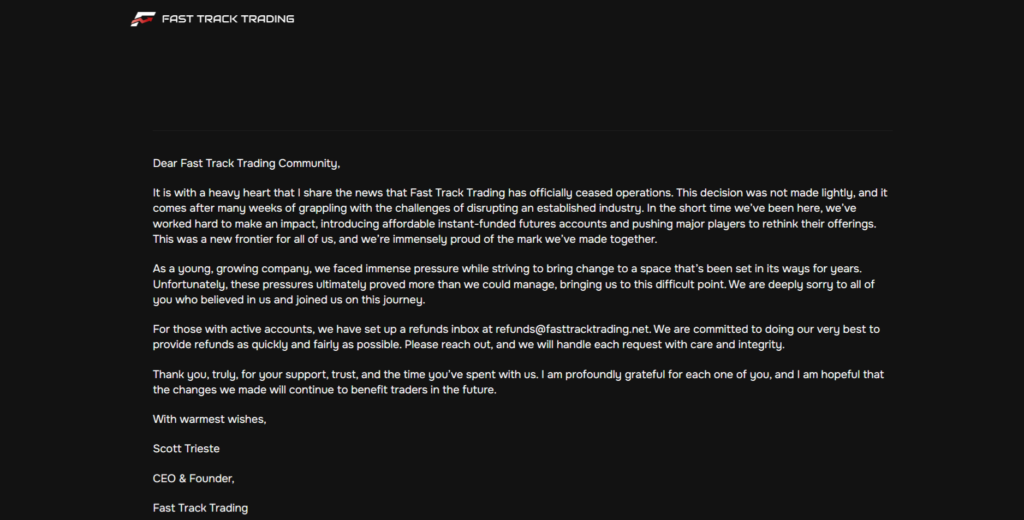

- Account Lockouts and Unpaid Payouts: Following the shutdown, Fast Track Trading has locked traders out of their accounts, and it’s reported that millions in payouts remain unpaid. Many traders have experienced delays of over 30 days in receiving their funds, with no resolution in sight.

- CEO’s Social Media Disappearance: Fast Track Trading’s CEO deleted his Twitter account after the shutdown, following months of unprofessional behavior that raised concerns about the firm’s credibility. The sudden disappearance has fueled speculation and concern within the trading community.

- Alleged Fraudulent Practices: Fast Track Trading is accused of manipulating payout charts by falsifying payout data on platforms like Rise. Allegedly, these funds were then redirected into personal accounts to finance luxury purchases, further casting doubt on the firm’s legitimacy.

Why Fast Track Trading’s Pricing Model Raised Red Flags:

Fast Track Trading’s appeal stemmed from its highly competitive pricing and promises of futures instant funding without a subscription. However, this incident illustrates the dangers of overly attractive offers in prop trading. Promising high payouts and low costs without a sustainable structure can often lead to unsustainable business practices. This Fast Track Trading shutdown is a cautionary example of why traders should carefully vet new firms.

Lessons Learned from the Fast Track Trading Shutdown:

The abrupt end of Fast Track Trading is a reminder that traders should be cautious of new firms offering deals that appear too good to be true in the prop trading industry. Choosing an established, reputable, and transparent firm is essential to avoid similar risks and safeguard trading funds.