In this Forex Prop Firm review, we uncover how the firm offers a platform designed to maximize trader success, providing up to $400K in initial funding with a high 95% profit share. Highlighting their commitment to flexible trading strategies and significant earning potential, this review will guide you through the essential features and benefits that make Forex Prop Firm a promising choice for traders aiming to scale their forex trading careers efficiently and effectively.

About Forex Prop Firm

Forex Prop Firm, managed by FPF Technology LLC with its base at 134 Yandell Road, Canton, MS, and 9452-8635 Quebec Inc. at 265 Place Chatel, Mascouche, Canada, has quickly risen in the proprietary trading industry. Since its inception on January 1st, 2022, the firm has supported over 3,500 traders and distributed over $7.4 million in payouts. With eight years of experience since 2016, Forex Prop Firm uses technology designed by traders to ensure a secure and effective trading environment. This growth and development are supported by numerous positive reviews and trader interviews.

Funding Program Options

Forex Prop Firm provides a variety of funding program options designed to suit different trading styles. They offer three challenge models and one instant funding program, each aiming to foster a comfortable trading environment:

- 1-Step Model: Traders aim for a 10% virtual profit with no time limit. Successful traders begin trading on a funded account with up to 100% profit split, based on performance.

- 2-Step Model: Involves two phases where traders prove their ability with realistic profit targets. Success leads to trading with a 90-100% profit split.

- Instant Funding: Provides immediate funding without the need for challenge completion and profit split of 80%.

Account sizes range from $10,000 to $400,000, allowing traders to choose the scale that best fits their strategy.

Fees

In evaluating the fee structure at Forex Prop Firm, it’s important to understand the different funding models available. These models cater to various trading preferences and strategies. From entry-level accounts to high capital options, traders can choose a model that best suits their trading style and potential growth trajectory. Here’s a detailed breakdown of the fees for each model, highlighting the financial commitment required and the trading conditions associated with each.

- 1-Step Model: Fees range from $94 for a $10,000 account to $1,899 for a $400,000 account, reflecting the model’s focus on achieving a 10% profit with liberal trading conditions like no maximum daily or overall loss limits, and no minimum trading days.

- 2-Step Regular Model: This model has higher entry costs, starting at $124 for a $10,000 account and going up to $2,399 for a $400,000 account. It introduces a phased approach with specific profit targets and conditions including a time limit for each phase and a mandatory number of trading days.

- 2-Step Infinite Model: Similar to the regular 2-step but with fees going up to $1,899 for the largest account size, emphasizing continuous evaluation and higher flexibility in trading conditions.

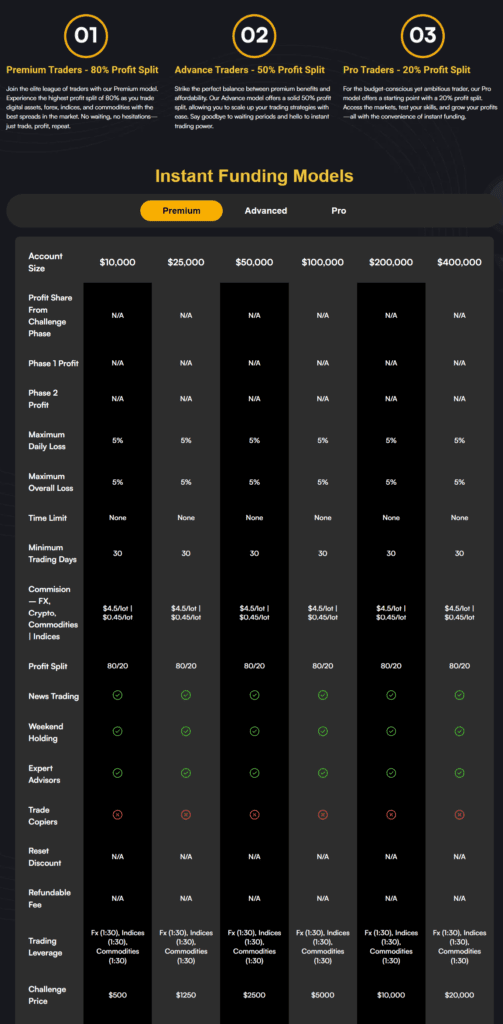

- Instant Funding: Instant Funding provides direct access to capital with prices from $500 for a $10,000 account to $20,000 for a $400,000 account, featuring fixed loss limits. There are three models: Premium Traders with an 80% profit split, Advance Traders with a 50% profit split, and Pro Traders with a 20% profit split.

Each model is designed to accommodate different trader needs and preferences, with corresponding costs reflecting the potential benefits and support each model offers. We’ll delve into more detail about each of the account models later on, so you can make an informed decision about which best suits your trading goals.

Tradable Assets

Forex Prop Firm offers a diverse range of tradable assets, including Forex, Commodities, Indices, Stocks, and Cryptocurrencies. The leverage available varies depending on the type of asset and the account status (challenge or funded).

- Forex: Major and minor currency pairs.

- Commodities: Trade contracts for oil, gas, precious metals, and more.

- Indices: Speculate on the performance of entire stock markets.

- Stocks: Trade shares of individual companies (limited leverage applies).

- Cryptocurrencies: Trade popular digital currencies (reduced leverage applies).

Leverage:

- Leverage is 1:30 for Forex, Commodities, and Indices.

- Leverage is capped at 1:10 for Cryptocurrencies.

- Leverage is capped at 1:5 for Stocks.

Trade Size:

- There are no minimum or maximum lot size restrictions.

- The maximum position size you can open depends on your account balance, free margin, and risk management strategy.

Spreads & Commissions:

ForexPropFirm works with data feed from an LP. You can log in with the following credentials to check out their competitive raw spreads across different instruments.

Email: testemaildemo@FPF.com

Password: 97#~COtHgW

Login Here: https://platform.forexpropfirm.com/

Trading Limits:

- To manage risk, there is a daily limit of 50 open positions or trades within a 24-hour period.

- Pending or cancelled orders don’t count towards this limit, only positions that are actively held.

- Exceeding this limit will result in account termination.

Restrictions

Forex Prop Firm has established a set of rules and restrictions designed to ensure a responsible and secure trading environment. Here’s a breakdown of the key trading rules and restrictions to know about ForexPropFirm’s Funding Program:

Drawdown:

- Absolute Max Drawdown: This limit is based on your starting account balance and won’t increase with profits.

- Daily Drawdown: Calculated from your account balance at the beginning of each day.

Stop Loss (SL):

- SL orders are not mandatory for every trade.

Hedging:

- Allowed within a single account, but strictly prohibited across multiple accounts.

Copy Trading:

- You can copy trades from your personal account to a challenge account, but with limitations:

- No mass copying.

- Each challenge account must have unique trades.

Challenge Attempts:

- You can attempt as many challenges as you want.

- However, the maximum funded capital you can acquire through challenges is $400,000 within two months. After that, you can increase capital through their scaling plan.

Expert Advisors (EAs):

- Only certain EAs are allowed. Prohibited EAs include:

- High-Frequency EAs

- High-Speed Scalping

- Tick Scalping

- Latency Arbitrage Trading

- Reverse Arbitrage Trading

- Hedge Arbitrage Trading

- Emulators

Trading Strategies:

- These strategies are prohibited:

- High-Frequency Trading

- Martingale Strategy

- Grid Trading (layering or adding to losing positions)

- You can strategically add to existing positions, but use caution and avoid abusing this option.

General Trading Rules:

- No excessive buying/selling without a strategy within 24 hours (max 50 trades/positions per day).

- Trade responsibly, as if managing real capital.

Cryptocurrency Trading:

- You can trade crypto on weekends.

Account Activity:

- To avoid inactivity termination, take at least one trade within 30 days of receiving a funded account.

Inactivity Period:

- Accounts become inactive after 30 days without a trade.

By understanding these restrictions, you can ensure you’re trading within ForexPropFirm’s guidelines and avoid account termination.

Challenge

Forex Prop Firm offers traders two primary challenge models, the 1-Step and 2-Step challenges, to qualify for funded accounts. Additionally, they provide an Instant Funding option for traders who prefer to bypass the challenge phase.

1-Step Challenge

The 1 Step Trading Challenge offered by Forex Prop Firm is structured to test traders’ abilities with clear and specific criteria. This challenge provides a straightforward path for traders to secure funded accounts.

Key Challenge Metrics:

- Profit Share During Challenge: 10%

- Profit Share Post-Challenge: 90/10 split

- Maximum Daily Loss: 4%

- Maximum Overall Loss: 6%

- Time Limit: None

- Minimum Trading Days: None

- Commission Rates: $4.5 per lot for FX, $0.45 per lot for Crypto, Commodities, and Indices

- Refundable Fee: 100%

- Trading Leverage: Fx (1:30), Indices (1:30), Commodities (1:30)

Additional Features:

- News Trading: Permitted

- Weekend Holding: Allowed

- Expert Advisors: Allowed

- Trade Copiers: Not Allowed

- Reset Discount: Available

The 1 Step Trading Challenge from Forex Prop Firm includes flexible rules with no time limits or minimum trading days, allowing traders to approach the challenge at their own pace. The profit split is set at 90/10 once the trader is funded, favoring the trader significantly.

The commission rates are low, and the leverage offered is good, which may benefit traders looking to maximize their trading potential. The challenge fees are refundable upon successful completion, which can be an attractive feature for those confident in their trading abilities.

Overall, the 1 Step Trading Challenge by Forex Prop Firm is designed to be straightforward and achievable, with conditions that support a range of trading styles and strategies.

2-Step Regular Challenge

The 2 Step Regular Challenge by Forex Prop Firm is designed to rigorously assess a trader’s capabilities over two distinct phases. Each phase comes with specific requirements and metrics, ensuring a comprehensive evaluation process.

Key Challenge Metrics:

- Profit Share During Challenge: 10%

- Phase 1 Profit: 8%

- Phase 2 Profit: 5%

- Maximum Daily Loss: None

- Maximum Overall Loss: 12%

- Time Limit: Phase 1 – 35 days, Phase 2 – 60 days

- Minimum Trading Days: 5

- Commission Rates: $4.5 per lot for FX, $0.45 per lot for Crypto, Commodities, and Indices

- Refundable Fee: 100%

- Trading Leverage: Fx (1:30), Indices (1:30), Commodities (1:30)

Additional Features:

- News Trading: Permitted

- Weekend Holding: Allowed

- Expert Advisors: Allowed

- Trade Copiers: Not Allowed

- Reset Discount: Available

The 2 Step Regular Challenge at Forex Prop Firm involves a two-phase process with defined time limits and profit targets. Phase 1 must be completed within 35 days, and Phase 2 within 60 days, with traders required to trade for at least five days in each phase. The overall loss limit is 12%, providing more flexibility than many other challenges.

Profit targets are set at 8% for Phase 1 and 5% for Phase 2. Upon successful completion, traders receive a 90/10 profit split.

The 2 Step Regular Challenge by Forex Prop Firm offers a structured and thorough assessment of trading skills, with clear requirements and competitive conditions.

2-Step Infinity Challenge

The 2 Step Infinity Challenge offered by Forex Prop Firm is a comprehensive trading evaluation with flexible terms and high-profit potential. This challenge is designed for traders who seek a rigorous yet adaptable assessment of their trading skills.

Key Challenge Metrics:

- Profit Share During Challenge: 10%

- Phase 1 Profit: 10%

- Phase 2 Profit: 5%

- Maximum Daily Loss: 5%

- Maximum Overall Loss: 10%

- Time Limit: None

- Minimum Trading Days: 3

- Commission Rates: $4.5 per lot for FX, $0.45 per lot for Crypto, Commodities, and Indices

- Refundable Fee: 100%

- Trading Leverage: Fx (1:30), Indices (1:30), Commodities (1:30)

Additional Features:

- News Trading: Permitted

- Weekend Holding: Allowed

- Expert Advisors: Allowed

- Trade Copiers: Not Allowed

- Reset Discount: Available

The 2 Step Infinity Challenge offers flexibility with no time limits, allowing traders to progress at their own pace. This challenge requires a minimum of three trading days, ensuring sufficient activity for evaluation. With a maximum daily loss capped at 5% and an overall loss limit of 10%, it balances risk and opportunity.

Profit targets are 10% for Phase 1 and 5% for Phase 2, with a 10% profit share during these phases. Upon successful completion, traders enjoy a 90/10 profit split.

Overall, the 2 Step Infinity Challenge by Forex Prop Firm is ideal for traders seeking a rigorous yet adaptable evaluation process.

Instant Funding

The Instant Funding option from Forex Prop Firm allows traders to bypass any preliminary challenges and receive immediate funding. This approach is tailored for traders ready to start trading with a funded account right away.

Key Metrics:

- Maximum Daily Loss: 5%

- Maximum Overall Loss: 5%

- Time Limit: None

- Minimum Trading Days: 30

- Commission Rates: $4.5 per lot for FX, $0.45 per lot for Crypto, Commodities, and Indices

- Profit Split: 80/20

- Trading Leverage: Fx (1:30), Indices (1:30), Commodities (1:30)

Additional Features:

- News Trading: Permitted

- Weekend Holding: Allowed

- Expert Advisors: Allowed

- Trade Copiers: Allowed

- Reset Discount: Not Applicable

- Refundable Fee: Not Applicable

The Instant Funding option at Forex Prop Firm offers traders immediate access to capital without the need for preliminary challenge phases, ideal for those with a proven track record. This allows experienced traders to begin trading right away.

Key conditions include a 5% maximum daily loss and an overall loss limit of 5%. Traders are required to maintain activity for a minimum of 30 days. There are three models with different profit splits: Premium Traders (80%), Advance Traders (50%), and Pro Traders (20%).

Commission rates remain competitive, and leverage options are consistent with other programs. This model is well-suited for traders seeking immediate market entry with a funded account, offering an efficient pathway to access trading capital.

Payout System

ForexPropFirm (FPF) offers a tiered payout system based on the account type you choose: Challenge Account or Instant Funded Account.

Challenge Accounts:

Challenge Accounts provide a competitive profit split of 90/10. This structure strongly incentivizes successful trading. Additionally, Challenge Accounts offer the potential to increase your profit share to 100% by meeting specific criteria outlined in the FPF Scaling Plan (details in the next section).

Withdrawal requirements for Challenge Accounts include:

- Profit Threshold: Initiate withdrawals after reaching a 5% profit on your funded account balance.

- Initial Lock Period: A 30-day waiting period before requesting the first withdrawal.

- Subsequent Withdrawals: Allowed every 15 days after the initial lock period.

- Processing Time: Typically 1-5 business days.

- Preferred Payout Method: RISE, with crypto and other options available (check for current offerings).

Instant Funded Accounts:

Instant Funded Accounts start with a slightly lower profit split of 80/20. The withdrawal rules for Instant Funded

Accounts mirror those of Challenge Accounts:

- Profit Threshold: Minimum profit of 5%.

- Initial Lock Period: 30-day waiting period before the first withdrawal.

- Subsequent Withdrawals: Allowed every 15 days.

- Processing Time: 1-5 business days.

- Primary Payout Method: Wire transfer, with crypto available for smaller amounts.

Additional Information:

- There are no restrictions on trading activity while waiting for a payout.

- Maximum drawdown limits do not affect your ability to withdraw funds.

- FPF offers multiple payout methods, with the possibility of future additions.

The next section will explore the FPF Scaling Plan, which allows for increased account size and potentially a 100% profit share.

Scaling Plan

The ForexPropFirm (FPF) Scaling Plan empowers funded traders to progressively increase their account size and profit potential. It’s your roadmap to potentially reach a staggering $10 million in trading capital!

Here’s how it works:

- Eligibility: Only funded accounts qualify for the Scaling Plan. Challenge Accounts cannot be scaled up directly.

- Instant Funded Accounts: You can scale up Instant Funded Accounts, but there’s a minimum threshold. Currently, the lowest account eligible for scaling is $25,000. If you have a $10,000 Instant Funded Account, you’ll need to make a one-time investment of 12.5% (of $10,000) to reach the $25,000 minimum and enter the Scaling Plan.

- Triggering a Scale-Up: Reaching a 10% profit on your funded account qualifies you for a scale-up opportunity. However, it’s not automatic. You choose whether to reinvest your profits for a bigger account or withdraw them.

- The Choice is Yours: You can’t withdraw 10% and scale up simultaneously. The 10% profit serves as the reinvestment amount for the scale-up process.

Requesting a Scale-Up:

- Profit Target: Achieve a profit exceeding 10% on your funded account, considering your profit split (refer to your account details).

- Investment: Dedicate 10% of your profits towards the scale-up (except for the transition from Step 5 to Step 6, which requires a 2% investment).

- Contact Support: Once you meet the requirements, send a scale-up request to support@forexpropfirm.com, including your account number.

- New Account: Upon approval, you’ll receive a new account with your increased balance.

- Processing Time: Allow 24-48 business hours for your scale-up request to be processed.

Key Points:

- Scaling up is a manual process, initiated by the trader.

- The 10% reinvestment is not a fee; it becomes part of your new, larger account balance.

- You can continue trading while your scale-up request is being processed.

With the FPF Scaling Plan, consistent profitability translates into significant growth potential.

Conclusion

ForexPropFirm (FPF) presents itself as a well-structured platform for aspiring and existing traders seeking a defined environment to develop their skills and potentially access substantial funding.

Key Features:

- Multiple Funding Programs: FPF offers a variety of challenge models and an Instant Funding option, catering to various experience levels and providing flexibility in the entry process.

- High Profit Potential: Competitive profit splits of up to 90/10 for challenge accounts and a well-defined Scaling Plan incentivize successful trading.

- Diverse Tradable Assets: FPF allows trading a broad range of assets, including forex, commodities, indices, stocks, and cryptocurrencies, accommodating various trading styles.

- Transparent Fee Structure: The fee structure is clear, with each funding model outlining its associated costs, allowing for informed decisions.

- Account Scaling Potential: The Scaling Plan provides funded traders with the opportunity to significantly increase their account size and unlock a potential 100% profit share through consistent performance.

Considerations:

- Challenge Requirements: While some challenges offer flexibility, others have specific time limits and profit targets.

- Instant Funding Profit Split: The 80/20 profit split for Instant Funding is lower than challenge-based options, but it offers immediate access to capital.

- Trading Restrictions: FPF maintains a set of trading rules and limitations to promote responsible trading. These restrictions may require adjustments for certain strategies.

Overall, ForexPropFirm offers a comprehensive platform designed to support aspiring and existing forex traders. With a variety of funding options, competitive profit structures, and the potential for significant account growth, FPF is a well-structured choice for those seeking to advance their trading careers.