Introduction

Welcome, funded traders! In the fast-paced world of trading, staying in the loop on the latest scandals and controversies is crucial. That’s why today, we’re diving into the eye-opening MyForexFunds scandal. Yes, you read that right. MyForexFunds, a name many of you might have trusted, is under the spotlight, and not for the best reasons.

So, why should you care? If you’re trading on any funding platform, understanding the pitfalls and shady dealings that have plagued others can help you make smarter decisions. We’re talking about your money and livelihood here; knowing who you can and can’t trust is essential.

The Mechanics of the Scandal

Software Manipulations

Explanation of “Delay” in Trading Software

In the trading world, time is money—literally. In the MyForexFunds scandal, one of the most unsettling aspects was the deliberate introduction of “delay” in their trading software. Delay, for those who might not know, is like a tiny pause that occurs between the moment you click to execute a trade and when it actually goes through. It might seem small, but even a split-second delay can result in significant financial losses in a market that moves at lightning speed.

Real-World Impact on Traders

For funded traders, this kind of delay is a nightmare. You might spot a perfect moment to buy or sell, but because of that delay, you could make the trade at a less favorable price. And if you’re trading in large volumes, those tiny differences can add up to a considerable amount. It’s like trying to catch a speeding train, but your shoes are tied together.

Explanation of “Slippage” in Trading Software

Slippage is another sneaky trick that was part of this scandal. Slippage occurs when a trade is executed at a different price than intended. While slippage can sometimes happen naturally due to market volatility, in the MyForexFunds case, it was intentionally programmed into the trading software.

Real-World Examples and Impact

Imagine this: you decide to buy a currency pair at a specific price, but due to slippage, you end up paying slightly more. On the flip side, when you’re selling, you might get less than what you aimed for. These minor price differences can result in hundreds or even thousands of dollars lost when trading high volumes.

Undisclosed Practices

Non-Disclosure of Software Manipulations

One of the most alarming parts of the MyForexFunds scandal was that these manipulations were not disclosed to the traders. People were operating under the assumption that they were trading on a level playing field, which was far from the truth.

Legal Implications

Legally speaking, these undisclosed practices could be grounds for serious lawsuits. Manipulating trading software in this manner can be considered fraudulent and could lead to civil and criminal charges.

Tactics Targeting Profitable Traders

Selective Delays and Slippage: How Traders Global Targets Profitable Traders

Just when you thought trading was tough, some companies make it even tougher for those who are actually doing well. Traders Global is notorious for targeting profitable traders by intentionally causing delays and slippage in their trades. Let’s put it simply: the better you are at trading, the more hurdles are thrown your way. So if you find yourself suddenly experiencing more “technical glitches,” it might not be a coincidence—it’s likely deliberate.

STP’ing a Customer’s Account: What It Really Means

What is STP (Straight-Through Processing)?

STP stands for Straight-Through Processing. It’s usually a good thing—transactions go smoothly from start to finish without manual checks. However, it’s essential to know that even something as straightforward as STP can be manipulated.

You’d think that Traders Global would play fair with STP, but that’s not the case. Here’s what they don’t tell you:

- STP is Rare: Out of 24,000 live accounts, fewer than 100 had a single trade STP’d. So, this isn’t for everyone; it’s reserved for traders who’ve managed to be consistently profitable.

- Performance Drop: Most customers on STP perform substantially worse than they did before. Over 70% made less money than when trading directly against Traders Global.

- Hidden Costs: Even with STP, Traders Global imposes additional spreads on the price feed visible to customers. This means that traders end up seeing—and getting—a worse price than what Traders Global got from the Dealer.

- Limited Losses for Traders Global: If you’re losing money on STP, so does Traders Global—but to a limit. Once you reach a certain loss threshold, your account is automatically disabled, limiting the company’s risk.

Financial Impact

Revenue and Losses

Let’s talk numbers for a moment. Traders Global has raked in an astounding $310 million just from customer registration fees. You read that right, a whopping $310 million! Now, you’d expect that a fair chunk of this money would go back to the traders in the form of payouts, right? Well, not exactly. The actual payouts to traders have been far less, totaling around $137 million. That’s a massive discrepancy and puts the spotlight on the real financial loss suffered by countless funded traders.

Personal Gains: The Lavish Lifestyle of Murtuza Kazmi

So, where has all that extra money gone? Enter Murtuza Kazmi, the mind behind Traders Global. While traders were grappling with losses and irregularities, Kazmi has been living it up. Luxury cars, exotic vacations, and top-of-the-line gadgets.

This glaring imbalance between the company’s revenue and trader payouts, coupled with Kazmi’s extravagant expenditures, raises serious questions about the financial ethics at play here. The personal gains enjoyed by Kazmi could have been funds returned to traders or reinvested into improving the trading platform. Instead, they have contributed to an atmosphere of mistrust and financial instability.

Insider Communications

Email and Instant Messages: The Damning Trail

Before diving into the gritty details, let’s clarify the roles of the people in question. The primary liaison between Traders Global and an external Advisor is none other than the “Head of Risk and Trading” at Traders Global, fondly referred to as “Traders Global Employee A.” It’s worth noting that this individual isn’t just an employee; they have a “stake” in the game. We’re talking about profit-sharing or some other form of arrangement that financially ties them to the company’s performance.

These communications weren’t just regular company chatter; they reveal a calculated agenda aimed at making sure customers, particularly funded traders, lose money. Yes, you read that correctly—the very platform that promises to help you amplify your trading gains might have been scheming to ensure you fail.

Curious about what’s really going on behind the scenes at Traders Global? We’re breaking it down for you. You’ll see what was actually said and what it means.

Employee A kicks off 2022 with a sense of urgency, lamenting over a customer who seems to have cracked their system using arbitrage. “If the strategy works for a month, we will lose more than a million dollars,” he grimly notes. This trader’s account is eventually suspended for violating rules, but not before costing the company around $100,000. The tone sets the stage for the firm’s discomfort when their clients succeed.

Just a couple of weeks later, on February 18, Employee A returns with another concern. During times of market volatility, customers can apparently make substantial gains without necessarily breaking any trading rules. He reveals that such success has nearly doubled the company’s financial outflows, which creates tension between him and the Advisor.

Fast forward to May 4, and the dialogue continues to divulge the company’s unethical underbelly. Employee A outlines that “very few customers” have made significant profits, but these are followed by considerable losses. The Advisor’s response of “that’s great to hear” stands as a chilling testament to the company’s actual stance on customer profitability: the less there is, the better for them.

On May 19, 2022, the phrase “Our traders are getting slaughtered today” isn’t just a casual remark. It reveals the unsettling glee within Traders Global when their clients lose money. Essentially, it reaffirms that their business model is built on the financial failure of their customers.

Come June 15, 2022, and the sentiment is the same. “We violated more accounts than made today. So hopefully the net is massive loss,” Employee A remarks. This statement underscores the perverse incentives at play: Traders Global profits when their clients don’t. It’s as if their business strategy is antithetical to the interests of their clientele.

Now, on to the tactics. When the company openly discusses using “delay and slippage” to limit customer gains, it shows a systematic approach to tilting the trading environment in their favor. They’re manipulating trades to be less favorable to you, the client.

And for those using bots? “I think we need another profile just for these accounts. And just slip them to hell,” says Employee A. This unveils a targeted strategy against bot users, designed to nullify any technological advantages they may have, making their trading conditions hellish.

By April 29, Employee A is almost sending out an alert about successful traders. “These accounts who go up so high so fast please alert us if you see them.” This is a direct attempt to identify high-performing traders and sideline them. Following up with, “This guy has done it twice and last time we paid him 120k,” shows how much they dislike parting with money, even when rightfully earned.

Speaking of money lost, “And the account is now dead :D,” celebrates Employee A. It’s not just business; it’s also a game to them, where the end goal is the termination of profitable accounts.

If you’ve been showing a consistent Profit and Loss statement, don’t think you’ve gone unnoticed. “Their running PnL is quite jagged but consistent upwards,” Employee A keenly observes. The aim here is to introduce enough trading friction, such as manipulated slippage settings, to pull you back down.

The Straight Through Processing or STP isn’t spared either. “Traders Global expects customers to lose money on STP,” reveals a rather insidious strategy to use even industry-standard practices to lead clients towards losses.

If you’ve managed to maintain profitability, beware. “He has been trading large sizes all this time, and getting paid for it,” warns an Advisor. There’s a reluctance to pay out large sums, showcasing a company that rewards loss more than success.

And for those pulling ahead in suspicious ways? “I will get their scaled account (it will be 100k) and we can STP it or start on aggressive and go from there but I don’t know if that will stop them from being profitable,” Employee A preempts. It appears they’re ready to tweak the rules on a whim to safeguard their profits.

Finally, a damning conclusion from Employee A: “Your clients will almost never have alpha. None of them will make money on real market conditions because they are good. Some will because they are lucky.” The company essentially views its clients as incapable of skillful trading, further justifying their manipulative practices.

The cold, hard truth is that the platform you’ve trusted your hard-earned money with has insiders who are actively working against you. Their goal isn’t to create a mutually beneficial relationship where both parties profit; it’s to funnel money away from traders and into the company’s pockets—and ultimately, toward those luxury expenditures of Kazmi we talked about earlier.

For every funded trader who’s ever scratched their head wondering why they’re losing money despite their best efforts, these insider communications could be the missing piece of the puzzle.

Legal Implications: What’s Next for Traders Global?

When it comes to the long arm of the law, Traders Global might find itself in a really tight spot. You see, the sneaky tactics employed by the company aren’t just unethical; they could also be illegal. Let’s break down the legal aspects and the possible outcomes that could be waiting for Traders Global.

The Case for Fraud

At the heart of the legal implications is the very real possibility of a fraud case. Manipulating trading software, delaying trades, targeting profitable traders—these actions could be considered deceptive practices aimed at defrauding customers. Courts could potentially hold Traders Global liable for both civil and criminal fraud. And trust me, that’s a huge deal. We’re talking hefty fines, asset seizures, and yes, even jail time for those at the top.

Securities Regulations

Traders Global could also face scrutiny under various securities regulations. The company has been collecting registration fees and delivering payouts, all while potentially skewing trading outcomes. This could catch the eye of regulators like the SEC (U.S. Securities and Exchange Commission) or its equivalent in other jurisdictions. Legal consequences could include suspension, hefty penalties, and even permanent bans from operating.

Contractual Breaches

Don’t forget, every trader enters into an agreement with the trading platform. If Traders Global is found to have manipulated outcomes intentionally, that’s a clear breach of contract. Traders could then legally demand compensation, not just for their losses but also for the emotional and financial stress caused.

The International Angle

Given that many trading platforms operate globally, Traders Global could also face legal action in multiple countries. Different jurisdictions have different laws and penalties, making this a legal nightmare for the company.

Class-Action Lawsuits

Last but not least, let’s talk about the power of the people. Affected traders could band together for a class-action lawsuit. In such cases, not only would Traders Global be fighting against individual traders but also facing a united front that demands justice.

In summary, the legal woes for Traders Global could be vast and complex, with the potential for multi-million dollar fines, extensive legal battles, and a tarnished reputation that may never recover.

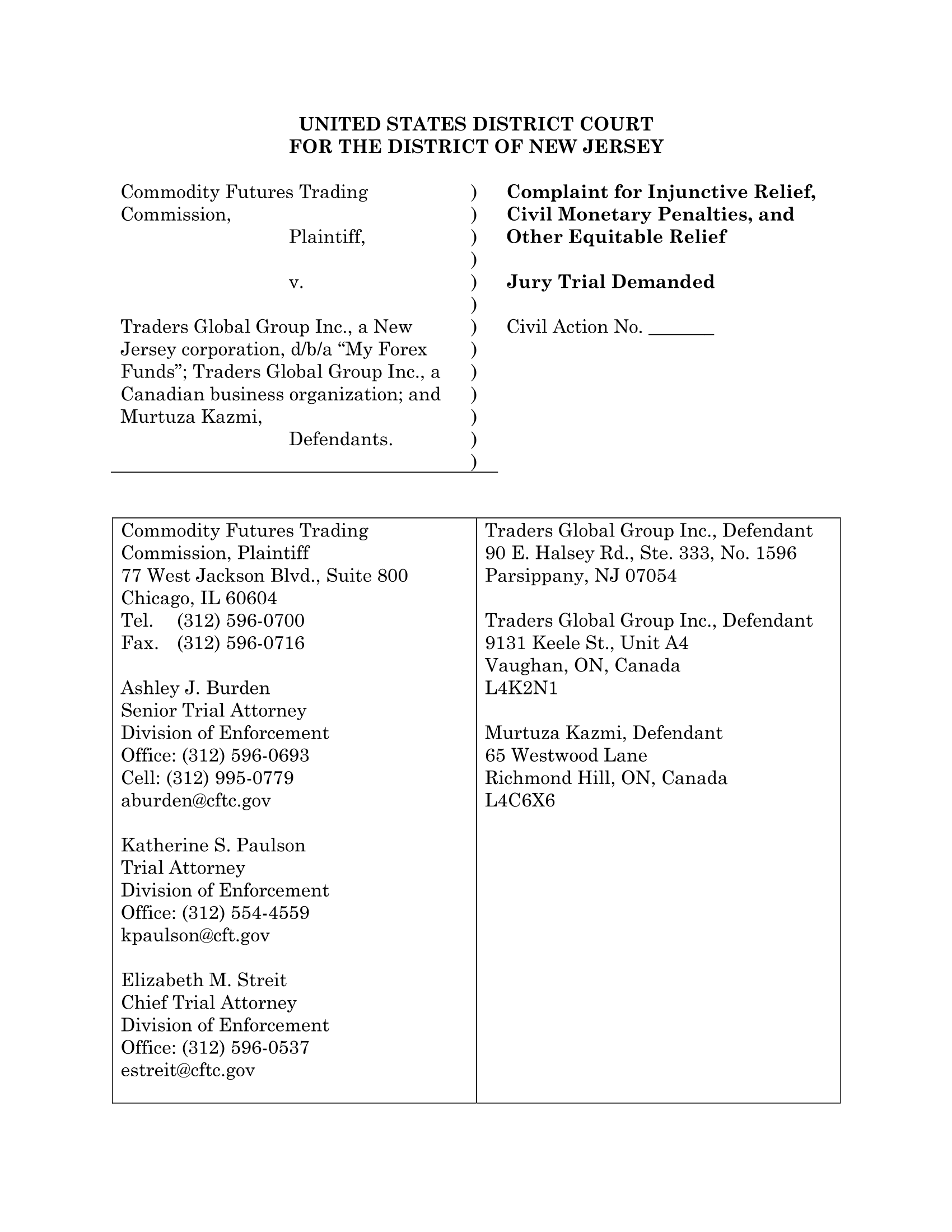

To delve deeper into this issue, we encourage you to download and read the full report provided by the CFTC. Click to download the full document from the CFTC website.

Conclusion: The MyForexFunds Scandal and What it Means for Funded Traders

So, we’ve taken a deep dive into the murky waters of the MyForexFunds scandal. From software manipulation to dubious internal communications and the potential for serious legal repercussions, it’s clear that this is no small issue. But let’s boil it down to what really matters for you, the funded traders.

The Trust Factor

Trust is the bedrock of any trading relationship. You put your hard-earned money and your trading skills into a platform, expecting fair play. The MyForexFunds scandal has shattered that trust for many, casting a long shadow over the industry as a whole.

Financial Repercussions

Think about it. You’re not just losing the potential profits but also the registration fees and any other costs involved. MyForexFunds raked in a staggering $310 million in customer registration fees while paying out just $137 million. That’s a financial imbalance that hits funded traders right where it hurts—the wallet.

Lessons to Be Learned

This scandal serves as a stern reminder to always do your due diligence. Vet your trading platforms, and read the terms and conditions. Also, keep an eye out for any unusual delays or slippage in your trades.

Moving Forward

Although the scandal has left many traders wary, it also serves as a catalyst for change. Regulatory bodies are now more alert than ever, and this could lead to stricter policies that actually protect traders in the future.

In summary, the MyForexFunds scandal is a cautionary tale with serious financial and ethical implications. But it’s also a lesson and an opportunity for funded traders to be more vigilant, more informed, and ultimately, more empowered in their trading journey.

And there you have it—the ugly truth and the way forward. Stay alert, stay informed, and always trade wisely.