Funding Frontier provides forex traders with up to $400,000 in capital, featuring flexible evaluation models, no time limits, and up to 95% profit split. With frequent payouts and a wide range of tradable assets, it’s a top choice for serious traders.

Funding Frontier is a forex prop firm that helps traders gain access to funded accounts with clear rules and fair evaluation challenges. With no time limits, realistic profit targets, and transparent conditions, traders can qualify for accounts up to $400,000 while keeping up to 90% of their profits. The firm focuses on making funding accessible with simple challenge options.

Traders can choose between 1-Step, 2-Step, or 3-Step challenges, allowing them to pick the best path for their trading style. The platform supports forex, indices, commodities, stocks, and cryptocurrencies, providing access to a variety of markets. With instant executions, competitive spreads, and a growing trading community, Funding Frontier offers a reliable environment for traders.

With thousands of active traders and millions in payouts, Funding Frontier has built a strong reputation in the prop trading industry. The firm’s clear funding process, lack of hidden rules, and straightforward trading conditions make it a solid choice for traders looking to grow their capital.

About Funding Frontier

Funding Frontier was established to provide traders with a fair and accessible way to secure funded capital. The firm was built on the idea that traders should have a clear path to funding without unnecessary restrictions or unrealistic profit targets. By offering straightforward evaluation programs, Funding Frontier has positioned itself as a trusted forex prop firm.

Since its launch, the firm has expanded its offerings, introducing 1-Step, 2-Step, and 3-Step challenges to cater to different trading styles. With no time limits on evaluations and achievable profit targets, traders have the flexibility to grow their accounts at their own pace. The firm has already paid out over a million dollars to successful traders and continues to support thousands of active accounts.

Funding Frontier is backed by a team of industry professionals dedicated to providing a smooth trading experience. The firm partners with reliable brokers and trading platforms to ensure accurate price feeds, fast execution, and competitive spreads. By focusing on transparency and trader success, Funding Frontier has built a strong reputation in the prop trading space.

Funding Program Options

Funding Frontier offers various funding programs designed to accommodate different trading styles. Traders can choose between instant funding or evaluation-based challenges. Each program includes fair profit-sharing, risk management guidelines, and access to a wide range of tradable assets.

Instant Funding

Traders start with a funded account immediately, without completing an evaluation. There are no profit targets, and traders keep a percentage of their earnings based on their selected profit split. Payouts are processed every 14 days, and optional upgrades can enhance the profit split and leverage.

1-Step Challenge

A straightforward evaluation process where traders must reach a profit target while managing risk. It includes a single evaluation phase and a payout structure that allows traders to keep up to 90% of their profits with an upgrade.

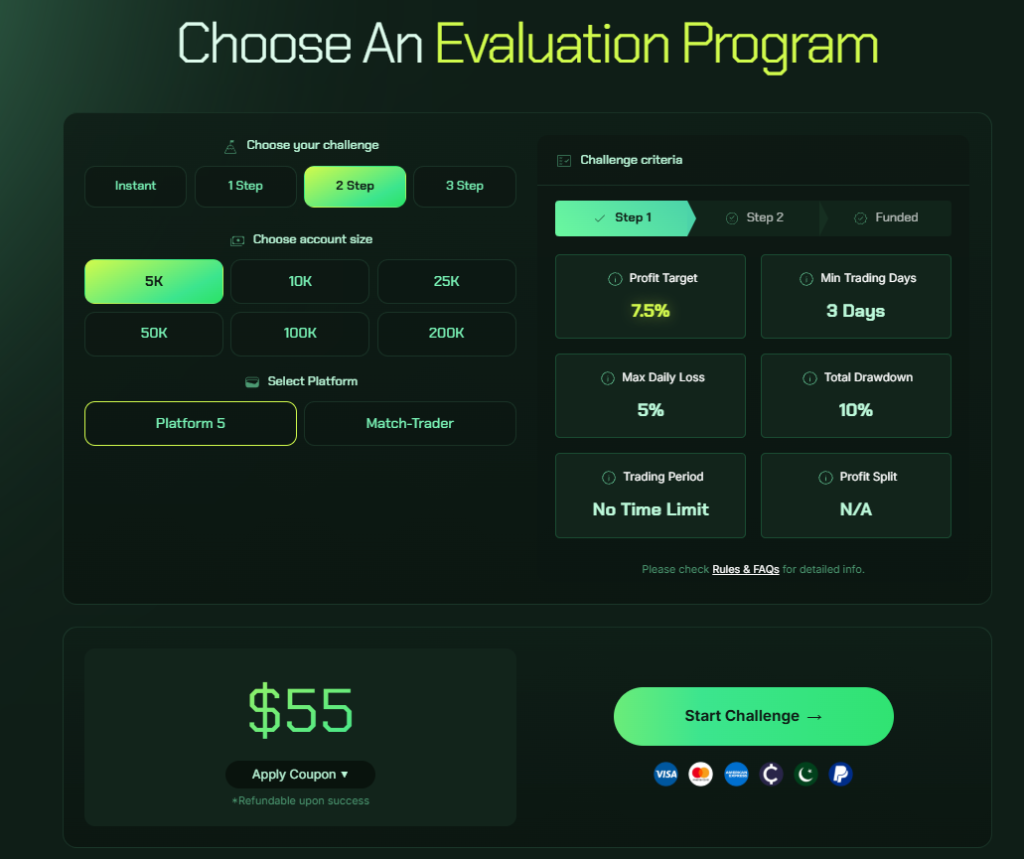

2-Step Challenge

A more structured approach requiring traders to complete two phases before securing a funded account. The challenge balances risk management and profitability, with an option to increase the maximum drawdown and profit split.

3-Step Challenge

A progressive evaluation that tests consistency over three phases. It is designed for traders who prefer a gradual qualification process. Optional upgrades include an increased profit split and double leverage.

Each funding option includes a clear payout system, accessible trading conditions, and the ability to scale accounts. Funding Frontier ensures traders can grow their capital while maintaining sustainable trading practices.

Fees

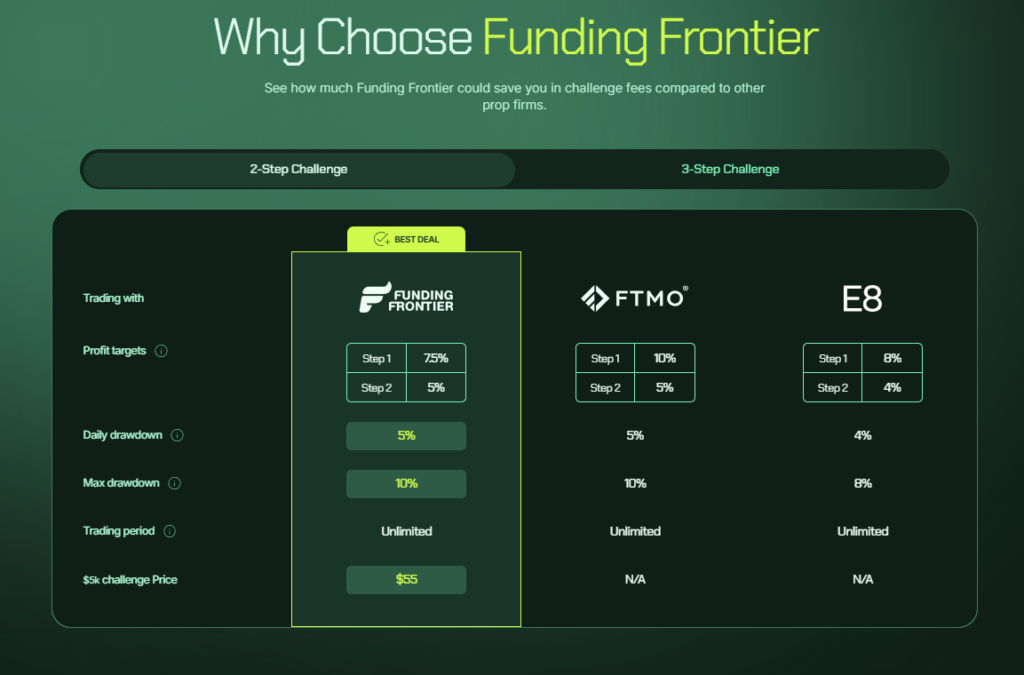

Funding Frontier offers a clear and competitive pricing model across its funding programs. The cost depends on the type of challenge and account size selected.

Instant Funding accounts range from $198 to $1,898, allowing traders to start trading immediately without an evaluation. The 1-Step Challenge fees range from $55 to $539, offering a single-phase evaluation with an optional 90% profit split upgrade. The 2-Step Challenge is priced between $55 and $1,050, with traders required to complete two profit target phases before getting funded. The 3-Step Challenge, designed for traders who prefer a gradual progression, costs between $49 and $389, with optional upgrades such as a higher profit split and increased leverage.

All evaluation fees are one-time payments, with no recurring charges. Successful traders who pass the evaluation receive a refund of their challenge fee, making the program more cost-effective.

Tradable Assets

Funding Frontier provides access to a diverse range of financial instruments across multiple markets. Traders can execute strategies on forex pairs, indices, commodities, stocks, and cryptocurrencies.

Forex trading includes major, minor, and exotic currency pairs, allowing traders to take advantage of global market movements. Indices such as the S&P 500, Nasdaq 100, and Dow Jones provide opportunities to trade the broader market. Commodities include metals like gold and silver, as well as energy assets such as crude oil and natural gas. The platform also supports stock trading, giving traders access to popular equities. Cryptocurrency trading is available, covering assets like Bitcoin and Ethereum.

With over 100 assets available, Funding Frontier ensures that traders have a wide selection of instruments to suit their trading strategies. All trading is executed on trusted platforms with real-time price feeds, low spreads, and instant execution.

Restrictions

Funding Frontier enforces several trading rules to maintain fairness and prevent exploitation of its evaluation programs. Traders must follow these guidelines to avoid violations that could lead to disqualification.

Automated Trading Restrictions

While expert advisors (EAs) are allowed, certain strategies are not permitted. High-frequency trading, tick scalping, latency arbitrage, hedge arbitrage, and order book spamming are strictly prohibited. Additionally, all trades must have an average duration of at least two minutes to prevent ultra-fast executions aimed at exploiting the system.

Copy Trading Limitations

Traders must trade each evaluation account independently. Using an EA or manually replicating trades from a master account to another within the evaluation phase is not allowed. Account management services are also prohibited, and all trades must be executed by the trader whose name is on the account.

News Trading Rules

During the evaluation phase, traders can freely trade during all news releases. However, funded traders are restricted from opening or closing trades within five minutes before or after a high-impact news event. Holding trades through news is allowed, but executing or modifying orders during the restricted time window will be considered a violation.

Prohibited Trading Strategies

Order book spamming, where traders submit numerous small orders to manipulate market activity, is not allowed. This practice creates an unfair advantage and places unnecessary strain on trading systems. Traders must avoid any strategies that artificially influence price feeds or execution speed.

Consequences for Violations

Breaking any of these restrictions can result in account termination or forfeiture of profits. Funding Frontier maintains strict enforcement of these rules to ensure a fair trading environment for all participants.

Challenge

Funding Frontier offers multiple challenge options, each designed to assess traders before granting funded accounts. Traders can choose between 1-step, 2-step, 3-step, and instant funding models, each with different requirements and drawdown rules.

1-Step Challenge

This challenge requires traders to achieve a 9.5% profit target while staying within a 4% daily drawdown and a 6% overall drawdown limit. The profit split starts at 80%, with an option to upgrade to 90% at checkout. Payouts are processed every 14 days.

2-Step Challenge

Traders must hit a 7.5% profit target in phase one and a 5% profit target in phase two. The daily drawdown is set at 5%, while the overall drawdown limit is 10%. The standard profit split is 80%, with an option to upgrade to 90% or increase the maximum drawdown to 12%.

3-Step Challenge

This challenge is designed for traders who prefer a more gradual evaluation process. The profit targets are 5% in phase one, 4% in phase two, and 3% in phase three. There is no daily drawdown limit, and the overall drawdown is capped at 5%. Traders receive an 80% profit split, with optional upgrades for a 90% profit share and increased leverage.

Instant Funding

Traders who want to bypass the challenge process can opt for instant funding. There is no minimum profit target, but traders must adhere to a 4% daily drawdown and an 8% overall drawdown, which locks at the starting balance. The profit split varies between 60% and 95%, depending on the account type. Optional upgrades include an 80% lifetime profit split and 1:50 leverage.

Each challenge is structured to give traders a fair chance to qualify for funding while ensuring disciplined risk management. Payouts are issued every 14 days for all models.

Conclusion

Funding Frontier provides traders with multiple evaluation models, including 1-step, 2-step, 3-step, and instant funding options. With no time limits, clear rules, and a competitive profit split of up to 95%, it offers traders a fair opportunity to grow their capital. The firm ensures a simple evaluation process while maintaining reasonable drawdown limits.

Traders have access to a wide range of markets, including forex, indices, commodities, and cryptocurrencies. The firm supports Match-Trader and other leading platforms, offering reliable trade execution with minimal restrictions. Payouts are processed every 14 days, ensuring consistent earnings for successful traders.

For those looking for a straightforward challenge, quick payouts, and access to a diverse range of tradable assets, Funding Frontier presents a strong option. Success depends on risk management and discipline, but traders who meet the requirements can secure long-term profitability.

Key Features

- Multiple evaluation models, including instant funding

- Up to 95% profit split with frequent payouts every 14 days

- No time limits on challenges

- Competitive drawdown limits for risk control

- Access to forex, indices, commodities, and crypto

- Supported on Match-Trader and other platforms

Considerations

- Automated trading and certain high-frequency strategies are restricted

- News trading is only allowed in the evaluation phase

- Consistency requirements apply in funded accounts

- Traders must adhere to drawdown and risk management rules

Funding Frontier provides a trader-friendly model with transparent rules and a clear path to funding, making it a solid choice for traders seeking capital.