Alpha Capital Group is a prop trading firm offering traders access to virtual accounts with funding up to $2,000,000. The firm allows traders to experiment with their strategies without any time restrictions, which helps ease the pressure and creates a more relaxed trading environment. Traders benefit from advanced dashboards, detailed analytics, and a live trading setup that closely mimics real markets.

One notable perk is the absence of commissions on trades, which makes it more cost-effective for traders. The platform also provides customized tools aimed at helping traders boost their performance and earn performance fees relatively quickly, making it a solid option for those looking to sharpen their skills.

About Alpha Capital Group

Alpha Capital Group offers a trader-focused platform aimed at helping users sharpen their skills and meet their trading targets. Founded by a team with deep experience in finance, the firm provides the tools and insights traders need to thrive. With virtual accounts that can be funded up to $2,000,000, traders can apply their strategies in a market environment that mimics real conditions.

One standout feature is the firm’s flexibility, there are no deadlines for evaluations. This gives traders the freedom to work on their strategies without rushing. The platform also provides detailed analytics through an advanced dashboard, allowing traders to track their progress and pinpoint areas for improvement. Plus, the no-commission structure keeps costs down, so traders can focus purely on performance.

Alpha Capital Group supports multiple trading platforms and offers personalized risk assessments, making it accessible for both beginners and seasoned traders. The firm also emphasizes education, with resources like the Alpha Academy designed to guide traders at every step. This supportive setup makes Alpha Capital Group a solid choice for anyone serious about improving their trading abilities.

Funding Program Options

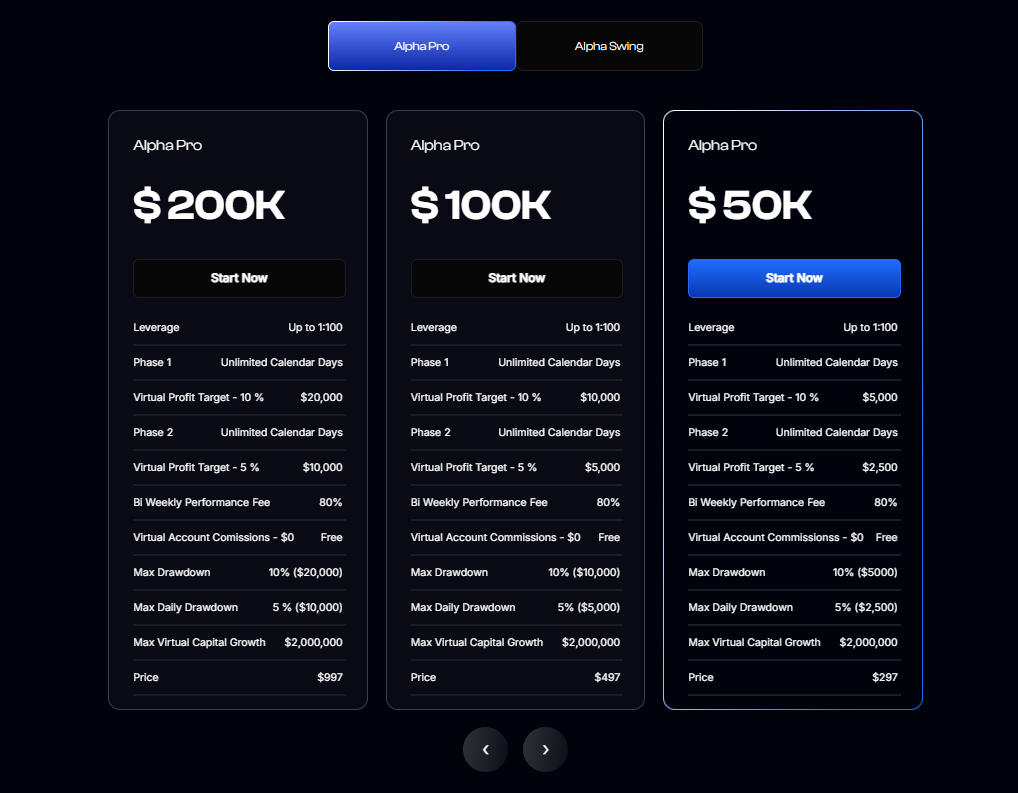

Alpha Capital Group offers two funding programs to match different trading preferences: Alpha Pro and Alpha Swing. Both programs feature a two-phase evaluation process without time limits, giving traders the flexibility to meet their targets at their own pace.

Alpha Pro

Alpha Pro allows traders to access funding from $5,000 to $200,000, with the potential to scale up to $2,000,000. To pass, traders need to hit a 10% profit target in Phase 1 and 5% in Phase 2. Risk management is enforced with a 5% daily drawdown limit and 10% overall drawdown. Traders can also use up to 1:100 leverage and enjoy unlimited trading days, offering a lot of breathing room.

After passing the evaluation, traders can earn up to 80% of performance fees and are allowed to hold positions over the weekend or during high-impact news events. This added flexibility makes Alpha Pro a solid choice for those who want more control over their strategy.

Alpha Swing

Alpha Swing caters to traders who prefer lower leverage and a more conservative approach. With funding amounts similar to Alpha Pro, starting from $5,000 and scaling up to $200,000, the program offers a maximum leverage of 1:30. Like Alpha Pro, traders need to meet a 10% profit target in Phase 1 and a 5% target in Phase 2, while following the same drawdown rules.

The Alpha Swing program is ideal for traders who want to hold positions during weekends and news events but prefer to limit their risk. This option also allows traders to scale their virtual capital to $2,000,000, offering room for growth based on performance.

Both programs have 0% commissions and let traders progress without time pressure, giving traders a clear, tailored path that fits their trading style and goals.

Fees

Alpha Capital Group offers a simple, transparent fee structure for both its Alpha Pro and Alpha Swing programs, allowing traders to pick the funding level that best aligns with their trading goals.

Alpha Pro Fees

- $5,000 account: $50

- $10,000 account: $97

- $25,000 account: $197

- $50,000 account: $297

- $100,000 account: $497

- $200,000 account: $997

Alpha Pro’s fees are fairly low relative to the funding offered, with traders able to access up to 1:100 leverage. This makes it a solid option for those looking to scale their accounts quickly without breaking the bank.

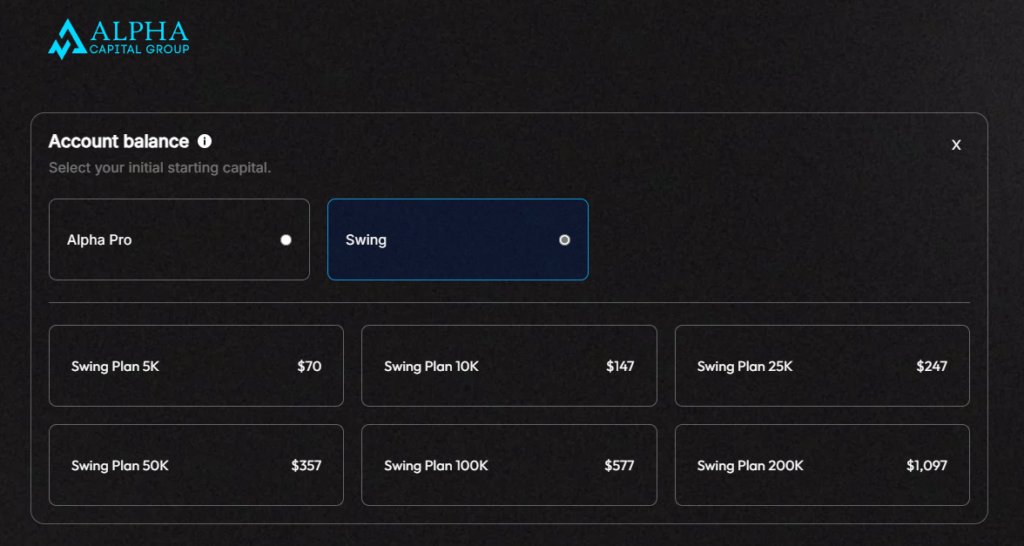

Alpha Swing Fees

- $5,000 account: $70

- $10,000 account: $147

- $25,000 account: $247

- $50,000 account: $357

- $100,000 account: $577

- $200,000 account: $1,097

Alpha Swing’s fees are slightly higher, reflecting its more conservative approach with 1:30 leverage. It’s a good choice for traders who prefer to grow their accounts at a steadier pace while managing risk more carefully.

Both programs charge a one-time fee for the evaluation, so traders can see the total cost upfront with no hidden fees.

Tradable Assets

Alpha Capital Group offers a broad range of tradable assets, giving traders the flexibility to build diverse strategies across major financial markets.

Forex

Traders have access to a wide variety of currency pairs, including majors like EUR/USD, GBP/USD, and USD/JPY, as well as minor and exotic pairs. This selection supports both short-term trades and longer-term strategies, offering plenty of opportunities to trade in global currencies.

Commodities

For those interested in commodities, Alpha Capital Group supports trading in key assets like gold, silver, crude oil, and natural gas. These assets are highly liquid, making them ideal for traders seeking to hedge against market risks or inflation.

Indices

The platform also includes access to major stock indices such as the S&P 500, NASDAQ, FTSE 100, and DAX 30. Trading indices lets traders speculate on broader market trends, offering an alternative to focusing on individual stocks.

Metals

Precious metals like gold and silver are also available, which can be useful for traders wanting to diversify their portfolios, especially during uncertain economic times.

With such a wide array of assets, Alpha Capital Group gives traders the tools to craft comprehensive trading strategies, whether they’re focused on forex, commodities, or broader market movements.

Restrictions

Alpha Capital Group has set clear rules to promote fair and independent trading. Traders must follow these guidelines to protect the integrity of their accounts and the platform.

Use of Trading Signals

The firm strictly prohibits the use of trading signals as part of its policy on group trading. Alpha Capital Group values traders who display independent market knowledge and decision-making skills. Using external signals is considered a breach of this rule and will lead to account termination.

Lot Size Limits

While there are no maximum lot size limits during the Alpha Pro evaluation, limits apply once traders reach the Qualified Analyst stage. These limits are based on account size:

- $5,000 account: Max 2.5 lots

- $10,000 account: Max 5 lots

- $25,000 account: Max 10 lots

- $50,000 account: Max 20 lots

- $100,000 account: Max 40 lots

- $200,000 account: Max 80 lots

- $300,000 account: Max 120 lots

These limits are designed to help traders manage risk effectively as they advance.

Minimum Trading Days Requirement

Even if traders hit their profit targets early, they must trade for at least three consecutive days to pass the assessment. Traders need to place at least one trade per day until the minimum day requirement is fulfilled.

Copy Trading

Alpha Capital Group allows copy trading under certain conditions. Traders can use external accounts as Master accounts by providing proof of ownership. Copy trading between two Alpha Capital Group accounts is also allowed, but traders must submit the account numbers of both the Master and Slave accounts before starting.

Hedging and Stacking

Hedging is allowed, meaning traders can hold both long and short positions on the same instrument. However, hedging for price or spread arbitrage is prohibited and can result in account closure. Hedging between two Alpha Capital Group accounts is also not allowed.

Stacking, or opening three or more trades in the same direction on the same instrument, is permitted as long as it complies with the firm’s risk management guidelines. Traders should use both hedging and stacking strategies carefully to avoid penalties.

Challenge

Alpha Capital Group offers a straightforward challenge structure for traders looking to secure funding. The challenge is split into two phases, giving traders the chance to show their skills and manage risk without being rushed.

Phase 1

In Phase 1, traders must reach a 10% profit target while keeping within a 5% daily drawdown and a 10% overall drawdown. There’s no time limit for this phase, allowing traders to trade at their own pace and apply strategies without worrying about deadlines.

Phase 2

After passing Phase 1, traders move on to Phase 2, where the profit target drops to 5%. The same drawdown rules apply: 5% daily and 10% overall. Again, no time limits are imposed, giving traders the freedom to focus on refining their strategy and performance.

Once both phases are completed, traders become eligible for a funded account, starting from $5,000 and scaling up to $200,000, with potential growth up to $2,000,000 based on performance.

Additional Features

- Unlimited Trading Days: There’s no rush to meet profit targets, giving traders as much time as needed.

- Hold Through News and Weekends: Traders can hold positions during high-impact news or over weekends, adding flexibility to their strategies.

- Minimum Trading Days: Even if the profit target is reached quickly, traders must complete a minimum of three trading days to pass the challenge.

This challenge structure focuses on a trader’s ability to balance profit and risk. With no time pressure, Alpha Capital Group provides traders the space to showcase their skills and work toward a funded account at their own pace.

Conclusion

Alpha Capital Group provides a flexible and supportive platform for traders aiming to secure funding. With the choice between Alpha Pro and Alpha Swing programs, traders can pick the approach that fits their style, whether they prefer higher leverage or a more cautious route. The absence of time limits in the evaluation process allows traders to progress at their own pace without added pressure.

The firm’s focus on disciplined risk management and the opportunity to scale accounts up to $2,000,000 make it a strong option for traders seeking to grow their capital. Traders also benefit from a wide range of assets, advanced trading tools, and the ability to hold positions during news events and weekends, offering the flexibility needed for success.

Key Features:

- Flexible Evaluation Options: Alpha Pro and Alpha Swing programs come with no time limits and strict risk management.

- Generous Funding: Accounts can scale up to $2,000,000 based on consistent performance.

- Wide Asset Selection: Access to forex, commodities, indices, and metals for a diverse trading experience.

- High Profit Share: Earn up to 80% of profits after passing the evaluation.

- Advanced Trading Tools: In-depth analytics and real-time data to refine your strategies.

Considerations:

- Strict Risk Rules: Traders must adhere to the 5% daily and 10% overall drawdown limits.

- No External Signals: Traders must rely on their own strategies, as external signals are prohibited.

Alpha Capital Group offers a strong balance of flexibility, growth potential, and reliable tools, making it an excellent choice for traders aiming for long-term success.