PipFarm Crypto Leverage

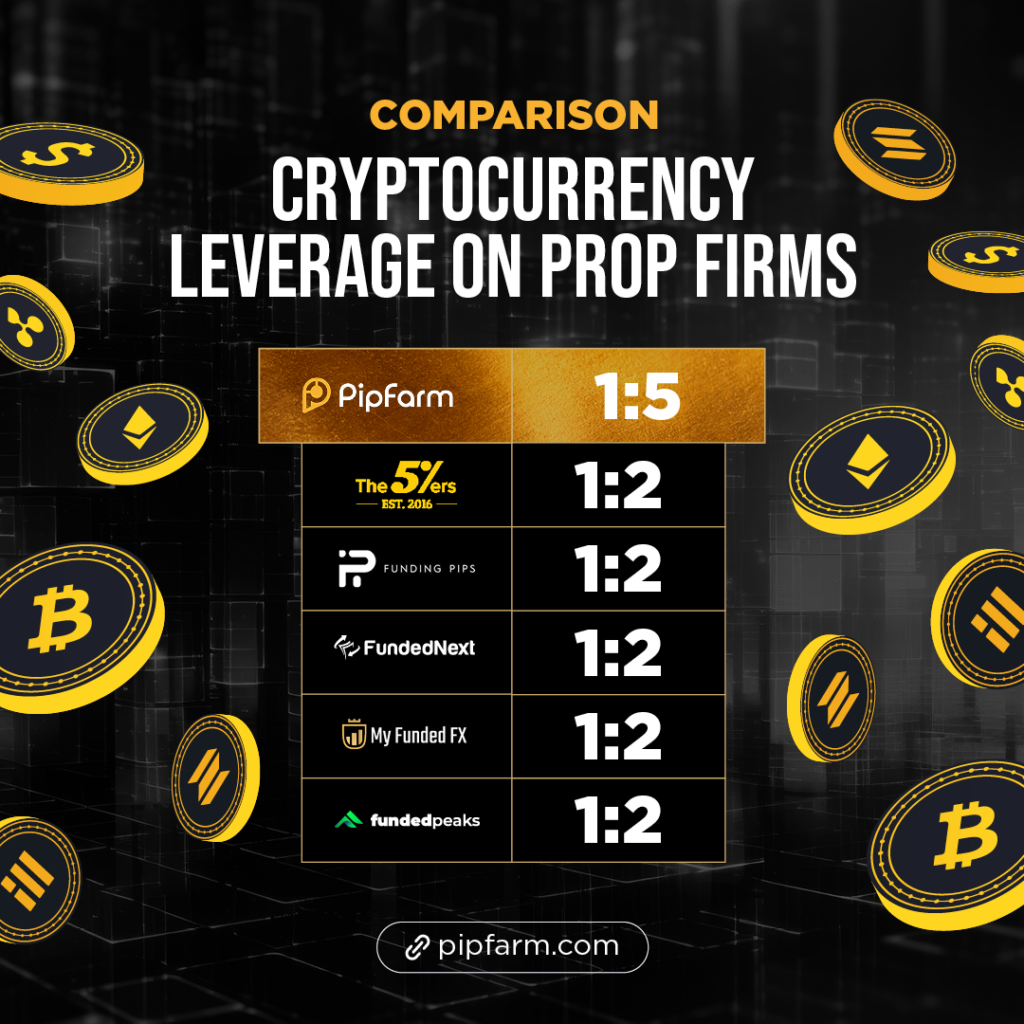

PipFarm has introduced 1:5 leverage for cryptocurrency trading, differentiating it from other prop firms, which typically offer 1:2 leverage for crypto assets. This new leverage option provides traders with increased exposure to the crypto market, which can amplify both potential gains and risks.

Understanding Leverage in Crypto Trading

Leverage allows traders to control a larger market position with less capital. With 1:5 leverage, a trader can manage a position five times the size of their initial investment. This can lead to higher potential profits, but it also increases the risk of losses, making effective risk management essential.

Comparing PipFarm’s 1:5 Leverage with Industry Standards

PipFarm’s decision to offer 1:5 leverage for crypto trading contrasts with the standard 1:2 leverage many other prop firms offer. The higher leverage ratio allows traders to take on larger positions, benefiting those with strong market strategies. However, it also requires a greater understanding of market dynamics and risk management techniques.

Implications for Crypto Traders

For those trading on PipFarm, introducing 1:5 leverage presents opportunities and challenges. The increased leverage can enhance the potential for larger returns, but it also means that the risks are proportionately higher. Traders must approach this leverage option cautiously, ensuring that their strategies are robust and prepared for the potential downsides.

This change in leverage policy may be particularly interesting to experienced traders looking for more flexibility in their trading strategies. However, the higher leverage also underscores the importance of a well-thought-out risk management plan.