Karma Prop Trader Shuts Down

Karma Prop Trader announced its closure in another blow to the proprietary trading industry. This marks yet another example of a prop firm succumbing to the market pressures, highlighting the critical importance of having a robust risk management team. A prop firm is often doomed to fail without proper risk checks and a solid operational foundation.

Operational Challenges

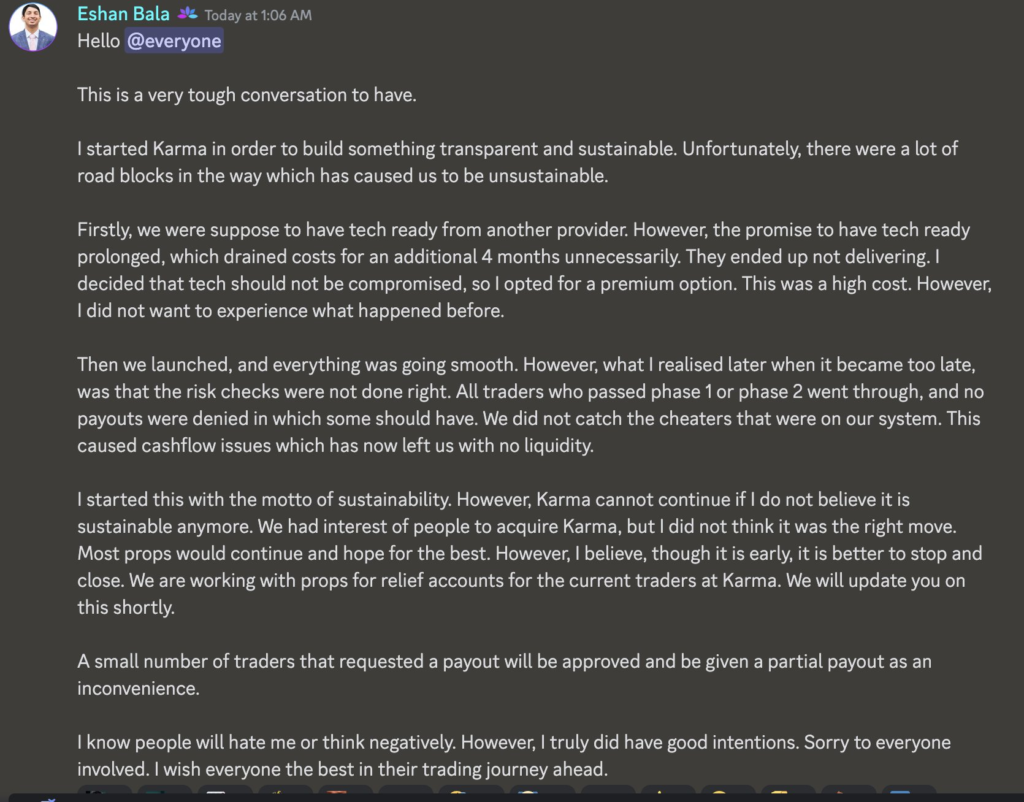

The CEO detailed several critical issues that led to the closure:

- Technology Delays: The firm initially faced significant delays from a technology provider who failed to deliver on time. This extended the development phase by an additional four months, draining resources unnecessarily. The firm opted for a premium tech solution to avoid further setbacks, significantly increasing costs.

- Risk Management Failures: Post-launch, the firm experienced issues with its risk management processes. The checks for traders passing through phases 1 and 2 were incorrectly executed. This failure allowed traders, including some who exploited the system, to receive payouts that should have been denied. The resulting cash flow issues drained the firm’s liquidity, leaving it unable to sustain operations.

Decision to Close

Despite interest from potential buyers, the CEO decided that closing the firm was the most responsible course of action. Under the current circumstances, the goal of building a sustainable and transparent business could no longer be met. Rather than continue under a cloud of uncertainty, the decision was made to shut down early to avoid further complications.

Impact on Traders

The firm is working with other proprietary trading firms to offer relief accounts to current Karma traders. Additionally, a few traders who requested payouts will receive partial payments as a gesture of goodwill for the inconvenience caused.

Final Thoughts

The CEO expressed deep regret over the situation, acknowledging that while the intentions behind Karma Prop Trader were good, the execution fell short due to unforeseen challenges.

This closure underscores the importance of robust operational and risk management practices in the proprietary trading industry, where the stakes are high and the margin for error is slim.